SCORE scale

What is the SCORE scale?

The SCORE (Systematic COronary Risk Evaluation) score is designed to assess the risk of fatal cardiovascular disease over a 10-year period. The scale was based on data from cohort studies conducted in 12 European countries (including Russia), with a total number of 205,178 people. There are two versions of the SCORE scale: for countries with low risk and countries with high risk of cardiovascular diseases (this includes Russia).

How to use the SCORE calculator?

To estimate the total risk of fatal cardiovascular disease using the calculator, you must indicate in the appropriate fields gender, age, systolic blood pressure level, whether the patient smokes and total cholesterol level. The resulting figure represents the probability of death from cardiovascular disease over the next 10 years, expressed as a percentage.

How to interpret the result?

Depending on the resulting risk value (in percentage), the patient should be classified into one of the following categories:

- Low risk – less than 5%

- High risk – 5% or more

When is the total cardiovascular risk higher than calculated?

It should be borne in mind that the total risk may be higher than calculated using the SCORE calculator if the following signs are present:

- There are signs of subclinical atherosclerosis according to ultrasound examination of the carotid arteries, electron beam or multispiral computed tomography

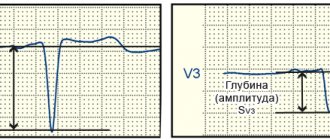

- Left ventricular hypertrophy was detected (according to ECG or echocardiography)

- Early development of cardiovascular diseases in close relatives

- Reduced HDL cholesterol, increased triglycerides, impaired glucose tolerance

- Increased levels of inflammatory markers (C-reactive protein and fibrinogen)

- For obesity and sedentary lifestyle

When should you not use the SCORE calculator?

The following categories of patients are considered high risk by definition and no additional SCORE calculation is needed:

- Diagnosis of cardiovascular diseases

- Diabetes mellitus type 1 and 2

- An increase in total cholesterol levels above 8.0 mmol/l or blood pressure above 180/110 mm Hg.

Sources:

- Conroy RM, Pyorala K, Fitzgerald AP, et al. Estimation of ten-year risk of fatal cardiovascular disease in Europe: the SCORE project. Eur Heart J 2003;24:987-1003.

- European guidelines on cardiovascular disease prevention in clinical practice: third joint task force of European and other societies on cardiovascular disease prevention in clinical practice (constituted by representatives of eight societies and by invited experts). Eur J Cardiovasc Prev Rehabil. 2003;10(4):S1-S10.

Oncologist warns which groups of people are at higher risk of developing cancer

Especially for Rossiyskaya Gazeta, oncologist Elkhan Ibragimov listed groups of people who are more likely to get cancer than others:

— Firstly, these are elderly people. After 55 years, the number of gene mutations in cells increases. Cancer is caused by cellular mutations. Most often, older patients are diagnosed with breast, lung, stomach, prostate and intestinal cancer.

Secondly, these are those who have blood relatives who suffer or have suffered from cancer. Especially if they met at a young age. But there is no direct relationship here.

Cancer is known to be a genetic systemic disease. But genetic does not mean hereditary. Therefore, even if both parents had or have cancer, this does not 100% mean that their child will also suffer from cancer.

Thirdly, these are people whose work involves radiation, workers in chemical plants, hazardous industries, and the like. Of course, we are talking about those who are in direct contact with carcinogens (arsenic, asbestos, benzene, etc.), and not about those who, for example, do accounting in the office at these enterprises. This also includes those who make furniture from chipboard, painters and generally anyone whose work involves constant inhalation of chemical fumes.

Fourthly, people suffering from obesity and diabetes are at risk.

Fifthly, those who have bad habits. For example, smoking increases the incidence of not only lung cancer, but also cancer of the larynx, nasopharynx, stomach, esophagus, liver, kidneys, and so on.

That is, it cannot be said that smoking or alcoholism increases the risk of developing cancer of any one specific organ. They negatively affect the entire body as a whole. But, of course, more often than others, those who abuse alcohol experience cancer of the stomach, intestines and liver. And for those who smoke more than one pack of cigarettes a day, the risk of developing lung cancer increases by 30 percent.

Thus, those who fall into these five risk groups should be more careful about their health. Get rid of bad habits, monitor blood sugar levels, stabilize weight and strictly follow sanitary rules and regulations in hazardous industries.

And what is also very important: undergo medical examination on time. After all, the earlier the disease is detected, the greater the chances of successful treatment.

GOALS AND PURPOSE OF THE RISK MANAGEMENT PROCESS IN THE ENTERPRISE

According to the generally accepted classification in risk management, risk means an event or set of circumstances, which, if realized, can significantly affect the achievement of the strategic goals and current objectives of the company. The impact of risk can be both negative, i.e., threatening the business, and positive, providing opportunities for its development. That is why the risk management process can be called the art of distinguishing whether an identified risk represents a danger to the company’s activities or, conversely, a chance to improve it.

The risk management system is a process carried out by both the company's management and its employees. The purpose of this process is to identify potential events that could affect the company's performance, either positively or negatively, and to ensure that the level of threats or the degree to which opportunities are realized is acceptable to the company.

A specific feature of this process is that it covers all business processes of the company without exception and is implemented within both external and internal business contexts (Fig. 1).

Basic principles of risk management:

1. Risk management is an integral part of the daily management process, which assumes that each employee is obliged to identify and assess risks for the most effective management decisions.

2. All risks that arise for external or internal reasons and can significantly affect the achievement of the enterprise’s goals must be identified, assessed and documented, and based on this information, risk measures must be developed.

3. The risk management process implies the use of a unified and standardized approach to identifying, assessing and dealing with risks.

4. Managers at all levels are responsible for the timely identification of risks, their assessment, development of risk management measures and informing all stakeholders, including employees, about the risks that affect the achievement of their goals, as well as for accumulating knowledge about risks and analysis of realized risks.

5. In the risk management process, a reasonable balance is required between the costs of risk management and the amount of possible damage or benefit from the occurrence of a risk event: if the level of risk is acceptable and the costs of risk management exceed the possible effect, additional measures to deal with this risk are not needed.

Risk management methods (Fig. 2):

1. Risk reduction implies influencing the risk by reducing the likelihood of the risk occurring or reducing the negative/increasing positive consequences in the event of the risk occurring in the future.

2. Risk transfer involves transferring risk (including partial) to another party (for example, insurance, hedging, outsourcing, etc. agreements are concluded) - this makes it possible to reduce the negative or enhance the positive impact of risk on achieving the company’s goals.

3. Acceptance of risk allows for the possible occurrence of the consequences of the risk with the identification of specific sources of coverage for damage from negative consequences.

4. Risk avoidance means refusal to perform actions/activities/goals characterized by a high degree of risk.

Now let's talk about how to manage risks.

Tax risk criteria

For all individual entrepreneurs and LLCs

- Low tax burden. It is calculated using a simple formula: the amount of taxes paid is divided by revenue and multiplied by 100%.

The obtained result is compared with the average for a specific industry. This data can be found in the public domain on the tax website. If the result is noticeably lower than the industry average, then you are one step closer to a tax audit. For example, you have a small hotel. During the year, we earned 1,200,000 rubles and paid 140,000 in taxes. Tax burden = (140000/1200000)*100% = 11.6%. This is higher than the average tax burden for the hotel business: it is 9.5%. So there is nothing to worry about. - Ignoring requests from tax authorities. If, during a desk audit, the tax office identifies errors in reporting or finds contradictions in the submitted documents, it sends a request to the company. According to the regulations, a response or explanation is sent to the supervisory authority within 5 working days. If a company doesn't respond, it may no longer exist. To find out if this is so, the tax office initiates an on-site audit.

- Repeated “movement” of the taxpayer between tax authorities. This applies to companies that change their location twice during a calendar year. Tax authorities interpret a change of address as a desire to avoid audits.

- Employee salaries are below the industry average in your region. Industry average data can be viewed on the Rosstat website. Why is this factor so important? It may mean that the company pays part of the salary in an envelope, therefore saving on taxes and contributions for employees.

- Repeatedly approaching the indicators of companies operating under special regimes to their maximum values. This criterion is valid for companies and individual entrepreneurs in special regimes: simplified tax system, UTII and unified agricultural tax.

If a company approaches the limit values by less than 5% at least a couple of times during the year, this is a reason for the tax authorities to take a closer look at the company’s activities. The limit values for the special regimes of the simplified tax system and UTII are specified in Art. 346.12, 346.13 and 346.26 of the Tax Code of the Russian Federation. We cited them in articles about the simplified tax system and UTII. For example, a company pays the Unified Agricultural Tax tax. It must receive at least 70% of its income from agricultural activities. Throughout the year, her income remains at 70-75%. The tax office suspects that the company has already lost the right to apply the regime and is understating its income from other activities. The inspector checks it according to other criteria and discovers that the employees’ salaries are below the industry average, or rather, all of them according to the minimum wage. He calculates possible additional charges and provides a verification plan to the manager. There is a knock on the door at the entrepreneur's office.

For the simplified tax system “Income minus expenses” and OSNO

- Reflection of losses in financial statements over several tax periods. The critical indicator is two or more calendar years. The supervisory authority may get the impression that this is being done artificially in order to avoid paying taxes.

- The growth rate of expenses exceeds that of income. What’s criminal about this, the entrepreneur asks? And there are plenty of reasons for suspicion: after all, there are ways to deliberately inflate expenses or reduce income. And all this with the goal of paying less taxes. If your expenses are growing, be prepared for the tax office to send a letter demanding clarification.

- The amounts of expenses are almost equal to the amounts of income received during the calendar year. This point applies to individual entrepreneurs. It is a signal that if the amount of expenses is as close as possible to the amount of income, tax authorities have every reason to believe that the entrepreneur is adjusting the amount to reduce the amount of tax.

For VAT payers

- Reflection in reporting of significant amounts of tax deductions for VAT. According to this criterion, companies operating on the common taxation system (OSNO) are checked. Why is it so important? Sometimes entrepreneurs abuse fictitious transactions with suppliers of goods and services in order to increase the size of the deduction. An alarming figure is 89% or more; the tax office has every reason to start an audit.

- Building activities through concluding agreements with a chain of counterparties without reasonable economic or other reasons. In other words, a company that operates in a chain of interconnected suppliers and buyers and spends fairly large sums of money has all the signs of a fly-by-night company. They are listed in more detail in the Resolution of the Plenum of the Supreme Arbitration Court of Russia dated October 12, 2006 No. 53.

- Conducting activities with high tax risks. The tax authority divides payers into three categories: low, medium and high risks.

High risk means that the company is similar to a fly-by-night company: perhaps it is involved in schemes to reduce VAT. The tax authorities provide the criteria on the website, in paragraph 12 of Appendix No. 2. Among them, for example, a lack of information about the company and the manager’s refusal to communicate. Dealing with problematic counterparties is also bad. The tax office will suspect that you are participating in the schemes. Therefore, check the company before making a deal.

Only for OSNO

- Low level of profitability. Relevant for companies on OSNO. For control, indicators of return on sales and assets for the industry are taken. If they are 10 percent or more lower, the tax office suspects a deliberate understatement of income. The calculation of profitability for different types of OKVED is specified in Appendix No. 4 to the Order of the Federal Tax Service of Russia dated May 30, 2007 N MM-3-06/ [email protected]